Market Bubble, Retail Frenzy, and Tracking the Big Whales

What do the successful investors think about the current market? Are we in a market bubble? How does the retail frenzy correlate with the market and market bubble?

Retail Investor Behaviours

- Active retail investors underperform the market by 6.5% every year, as compared to 1.5% for investors who buy and hold.

- Gambling : Retail investors’ decision-making process is mainly dominated by the magnitude of the potential winning, rather than its probability.

- Robinhood 50 list — equities on this list are more correlated to retail investors’ market activities than the stocks that are not on this list

Retail Investors’ Underperformance factors:

- Overconfidence in their investing decisions (high portfolio turnover)

- Poor risk evaluation

- Overreacting to news events causing high portfolio turnover

- Believing they can predict the market

Retail Investors are More interested in depressed stocks:

- Compared to undepressed stocks, depressed stocks are more likely to attract retail investors at year-end and experience an increase in retail investor attention

Tracking the Big Whales and Their Q1 Trades

“Big Whales” Perspectives: Views on Market Bubble

- Michael Burry: “People ask me what’s going on in the market? It’s simple. Greatest Speculative Bubble of All Time in All Things.”

- Ray Dalio: Some stocks are in a serious bubble, while some are not

So, which companies do the successful hedge fund managers use to hedge against the market bubble?

Who to track?

Consensus of 7 Successful Investors’ Trades during Quarter 1 — Which sectors did they buy/sell?

7 Investors in the consensus:

- Michael Burry

- Cathie Woods

- Warren Buffett

- Stanley Druckenmiller

- Prem Watsa

- Bill Gates Trust

- Tiger Global

- Buys & Increased Holdings Vs. Sells & Reduced Positions

- Hold:

Consensus of 7 Investors’ Trades during Quarter 1 — Which Stocks?

- Buys & Increased Vs. Sells & Reduced Positions:

- Hold:

7 Investors — Individual Portfolio Analysis

Michael Burry — Scion Asset Management

- Q1 Transactions as % of Portfolio:

Stanley Druckenmiller — Duquesne Family Office

- Q1 Transactions as % of Portfolio

Warren Buffett — Berkshire Hathaway Inc.

- Q1 Transactions as % of Portfolio:

Prem Watsa — Fairfax Financials

- Q1 Transactions as % of Portfolio:

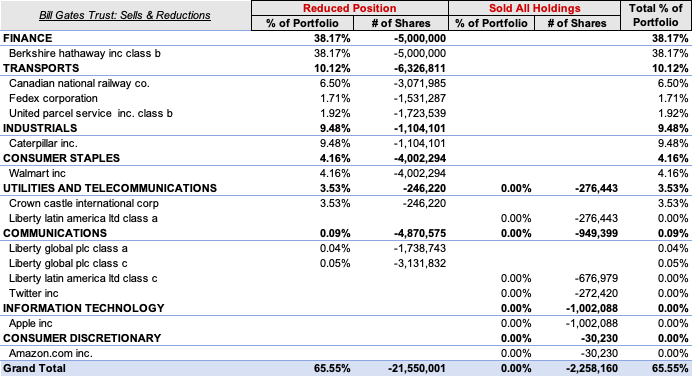

Bill & Melinda Gates Foundation Trust

- Q1 Transactions as % of Portfolio:

Tiger Global Management

- Q1 Transactions as % of Portfolio:

Cathie Woods — Ark Investment Management

- Q1 Transactions as % of Portfolio:

Watch the Market Bubble — Optimistic Investor Sentiment

- Investor sentiment significantly predicts stock bubble probability, with a higher probability of bubble occurrence following periods of higher investor sentiment.

- A more optimistic investor sentiment also increases the size of stock bubbles.

- Sentiment has the tendency to reach its peak prior to the bubble’s peak

- Thus, Investor sentiment has strong predictive power for bubble bursts.

- Overall, retail investors optimism + overall market positive investor sentiment → Market Bubble?