Investment Analysis of Pfizer Inc. (NASDAQ: PFE)

By Dr. Darren Yong

Executive Summary

· Pfizer is the world’s leading supplier of pneumococcal disease and COVID-19 vaccines.

· Prevnar13 is Pfizer’s highest income generator, but growth has been stagnant over the past 5 years and is set to face competition with Merck’s potentially superior Vaxneuvance.

· Investment drivers: Continued demand for SAR vaccine and commitment to dividend payments to shareholders.

· Investment risks: No in house technology to capitalize on mRNA momentum, increased vaccine competition.

· Recommendation: Hold, high expected revenue from vaccine sales but development of new breakthrough medicines is low.

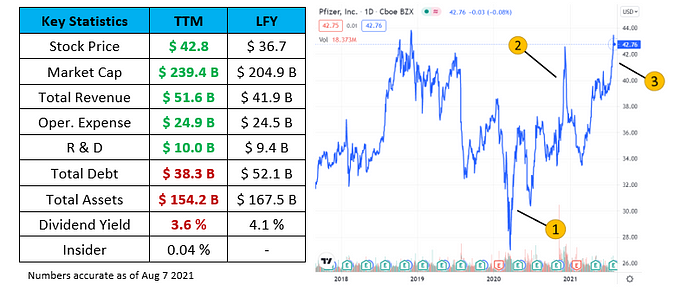

1) Mar 17 2020: Announced that Pfizer and BioNTech have agreed co-development and distribution a potential mRNA-based coronavirus vaccine aimed at preventing COVID-19 infection.

2) Dec 11 2020: FDA issues first emergency use authorization of BNT162b2 for individuals 16 and older.

3) Jul 9 2021: Pfizer provides positive data suggesting strong neutralizing titers against Delta variant.

About Pfizer Inc.

Pfizer Inc is a pharmaceutical company that develops a broad range of therapeutics for inflammation, immunology, internal medicine, oncology, rare, and infectious diseases.1 Modalities include small molecule inhibitors, monoclonal antibodies, other kinds of biologics and prophylactic vaccines. As of July 28 2021, Pfizer has 92 clinical programs with 25% of them currently in Phase 3.1,2 Currently 5 oncology programs have been discontinued since May 4 2021. Recent drug approvals include lorlatinib (lung cancer), Prevnar 20 (pneumococcal vaccine), Relugolix (uterine fibroids), Enzalutamide (prostate cancer) and PF- BNT162b2 (COVID-19 vaccine). BNT162b2 was the first COVID-19 vaccine to be approved for adults in Canada and Pfizer continues to seek full approval for all age groups.

Pfizer’s vaccine division: Pfizer’s vaccine division is focused on developing vaccines against two respiratory bacterial pathogens, Streptococcus pneumoniae and Neisseria meningitidis.2 These pathogens spread from person to person by aerosol transmission or direct contact. Pfizer is also expanding its vaccine business to include tick-borne encephalitis, Clostridioides difficile infection, Respiratory Syncytial Virus Infection, SARS-CoV2 and Lyme disease.

Streptococcus pneumoniae and Pneumococcal disease

Pneumococcal disease: Pneumococcal disease is caused by a bacteria called Streptococcus pneumoniae. There are 92 identified serotypes of S. pneumoniae with 15 of these causing the majority of disease in humans.4 S. pneumoniae infection can cause pneumonia (lung), bacteremia (blood), sinusitis (sinus), meningitis (brain and spinal cord) and otitis media (ear).5 Pneumococcal disease is among the top 2 causes of bacterial meningitis in children under the age of 5. There are approximately 14.5 million infections per year and 500,000 deaths globally.4,6,7 Risk factors include age with children <2 years and adults over 65 years old being the most susceptible. Additionally, those who have chronic heart, kidney and lung diseases, also have increased risk.5

Prevnar mechanism of action: Prevnar is one of the two pneumococcal vaccines approved by the Center for Disease Control and Prevention.5 Prevnar13 is composed of capsular polysaccharides from 13 different serotypes of S. pneumoniae (1, 3, 4, 5, 6A, 6B, 7F, 9V, 14, 18C, 19A, 19F and 23F).6,8 These capsular polysaccharides are conjugated to a non-toxic mutant of diphtheria toxin to stimulate an immune response. Prevnar20 is Pfizer’s third generation pneumococcal vaccine that adds 7 additional capsular polysaccharides serotypes (8, 10A, 11A, 12F, 15B, 22F and 33F) on top of Prevnar13. These additional serotypes are associated with high fatality rates, antibiotic resistance and/or meningitis.

Market: In 1998, 95 out of 100,000 children in the US had invasive pneumococcal disease.9 Since the introduction of Pfizer’s Prevnar7 (precursor to Prevnar13) in 2010 and Prevnar13 in 2010, the number of cases has dropped by 91 % as of 2018. Prevnar13 remains one of Pfizer’s best-selling products with global sales reaching $5.9 billion in 2020, making it the best-selling vaccine in the world prior to the SARS-CoV2 pandemic.1,10 In 2021, Prevnar13 continues to be a primary revenue generator for Pfizer. In Q2 of 2021, Prevnar13 brought in $1.2 billion in revenue from sales in the US and $2.3 billion internationally.11 Sales in the US increased 10% within the same quarter since 2020 due to the reopening and increased healthcare checkups. However, year to year growth has been stagnant over the past 5 years with 2020 seeing 1.07%.12

Neisseria meningitidis and Meningococcal disease

Meningococcal disease: Meningococcal disease is caused by a bacteria called Neisseria meningitidis.13 There are 12 identified serotypes of N. meningitidis, 6 of which are infectious to humans (A, B, C, W135, X, Y). Bacterial meningitidis is an uncommon life threating condition. Globally there are over 1.2 million cases of bacterial meningitis infection with serotype prevalence varying by country and age group. For example, the predominant serogroups in South Africa are A, C, W135, and X, while in Europe B, C are the most prevalent.14 If left untreated fatality rates can be as high as 70% and survivors can be left with neurological impairment, loss of hearing or limb amputation.

Meningococcal vaccine mechanism of action: Pfizer has two approved meningococcal vaccines to address different serotype markets around the world.2 Nimenrix is a cocktail of 4 capsular polysaccharides from serogroups A, C, W135 and Y that are conjugated to a tentanus toxid carrier protein.15 Trumenba is bivalent recombinant lipoprotein vaccine for immunization against serogroup B.16 Currently Pfizer is testing a universal meningococcal vaccine candidate (PF-06886992) that combines Nimenrix and Trumenba for protection against A, B, C, W135, and Y serogroups.17

Market: Together, A, B, C, W135, and Y serogroups account for 96 % of all invasive meningococcal disease.17 Nimenrix was approved in April 2012 for use outside of the US and generated $49 mil in revenue in Q2.11 Trumenba was approved in October 2014 for use inside the US against serogroup B. Since Trumenba has been on the market, the number of new cases of meningococcal disease in the US has decreased 12% as of 2018 and has remained steady since 2015.18,19

SARS-CoV2 and COVID-19

Coronavirus vaccine development history: Coronaviridae is a family of enveloped positive strand RNA viruses that have caused several global outbreaks around the world. In February 2003, the Severe Acute Respiratory Syndrome COronaVirus (SARS-CoV) first appeared in China. By July 2003, it had spread to 29 other countries, infecting 8,096 people and causing 774 deaths around the world.20 The SARS-CoV outbreak was successfully managed through quick public health measures, frequent testing of symptoms, quarantining and restricted travel. No cases of SARS-CoV have been reported since 2004. This relatively small outbreak has estimated to have cost the world $ 40 billion dollars.20 In 2012, the Middle eastern Respiratory (MERS) coronavirus was first reported in Saudi Arabia and quickly spread to 27 countries, with 2,574 reported cases and 886 deaths as of June 2021. 21 Prior to 2020, no coronavirus vaccine was available due to lack of interest and funding.22 In 2019, Coronaviridae again made headlines with SARS-CoV2, which marked the beginning of the current global pandemic.

In March 2020, Pfizer announced it will co-develop a SARS-CoV2 mRNA vaccine with BioNTech. By April 2020, phase 1 trials begin for their lead candidate, BNT162b2.23 By November 2020, BNT162b2 demonstrated 95% effectiveness against SARS-CoV2 and was well tolerated across all of its 43,000 enrolled participants in a phase 3 study.24 By December 2020, Pfizer receive authorized emergency use of BNT162b2 for preventing severe disease caused by SARS-CoV2. This landmarks the fastest development cycle for a vaccine in human history.25 In comparison, the previously fastest vaccine from time of development to deployment was the mumps vaccine, which took 4 years.

BNT162b2 mechanism of action: BNT162b2 is comprised of a modified non replicating mRNA sequence for encoding the SARS-CoV2 prefusion spike glycoprotein.26 The mRNA sequence is modified with mutations that stabilize the spike protein specific conformation that is pro antigenic to the immune system. The mRNA is encapsulated in a lipid nanoparticle to protect the payload from degradation and allows it to be delivered into the host cell. Once inside, the host cellular machinery translates the mRNA into the SARS-CoV2 spike protein and displays it at the cell surface. The spike protein is recognized by the immune system and triggers the production of neutralizing antibodies against the spike protein to prevents future viral infection.

Market: As of Aug 5, 2021, SARS-CoV2 has affected 220 countries, infected 200.8 million people and attributed to 4.2 million deaths worldwide.27 Approximately 4.4 billion doses have been administered globally with 29.7 % of the world’s population receiving at least 1 dose and 15.3 % receiving 2. However, only 1.1% of people in low-income countries have received at least one dose. Since December 2020, Pfizer has delivered approximately 1 billion doses of BNT162b2 and is expected to deliver 2.1 billion by the end of 2021.1,11

Investment drivers

Pfizer further differentiates in infectious disease market among vaccine giants: Among the 4 major vaccine manufacturers, Pfizer was the only one to deliver a COVID-19 shot.28,29 This is due to Pfizer’s partnership with BioNTech and adoption of their mRNA technology. Sanofi was also in development of a mRNA vaccine with its partner Translate Bio but were way behind BioNTech in clinical trials. GlaxoSmithKline opted to develop a recombinant protein-based adjuvant as an ingredient to boost the effectiveness of their competitor’s vaccines instead of developing their own from scratch. Merck attempted make a SARS-CoV2 vaccine using their Ebola vaccine technology, but clinical efficacy results were disappointing. The market is now saturated with SAR-CoV2 vaccines and has deterred vaccine makers from playing catch up.29

Continued demand for vaccines is driving high fiscal performance: Pfizer’s bet on a relatively unproven technology during an emerging crisis has paid off. Pfizer now supplies 23% of the world’s COVID-19 vaccine supply and is expected to increase with much of the developing world still requiring a first dose1,27. Due to the global prevalence of infectious diseases, the market is forecasted to grow with an annual compound growth rate of 7.2% and expected to reach a market size of 39.8 billion by 2026.30 Pfizer’s Q2 earnings report an 86% increase in operational growth, largely due to BNT162b2.1 BNT162b2 bought in $7.8 billion in direct sales and is anticipated to generate $33.5 billion in revenue by the end of 2021.11 Further more, endemic driving factors such as waning immunity and viral evolution may drive the need for booster shots, development of new variant specific vaccines and or formulating multivariant cocktails. Israel already has announced plans to administer Pfizer booster shots (3rd dose) to vulnerable citizens.31 Prevenar13 alone was responsible for 6.5% of total revenue in the Q2 of 2021. This increase in demand is due to the reopening allowing an increase in non-COVID related healthcare visits compared to last year.

Multibillion dollar drug portfolio set to continue to sustain revenue income and return to shareholders: Pfizer has seen a 92% increase in revenue growth and a 2–28 % increase operational growth across all divisions compared to the same quarter in 2020.11 Q2 earning reports $18.9 billion in total revenue with top earnings coming from vaccines (41% from BNT162b2 + 6.5% from Prevnar13), oncology (16.6%) and internal medicine (12.7%). On July 29 2021, Pfizer paid $2.2B in dividends at $0.39/share making it the 330th consecutive quarter of payments to shareholders.1

Investment risks

Pfizer unlikely to be able to capitalize on mRNA vaccine momentum: Pfizer’s successful partnership with BioNTech has sparked interest for research and development of mRNA-based medicines. Biotech companies are investigating whether mRNA technology can be broadly applied to develop therapies for other infectious diseases and areas of oncology. Pfizer is significantly behind Moderna in this regard. Pfizer does not have a strong history of developing mRNA medicines in house and does not currently have any candidates in clinical trials. In contrast, Moderna has several mRNA-based therapeutics for influenza, HIV, Zika and Respiratory Syncytial virus in phase 1 and phase 2 respectively.32 Sanofi recently acquired Translate Bio to strengthen their mRNA therapeutic business. Pfizer is unlikely to do the same with BioNTech due to BioNTech’s partnerships with other pharmaceutical companies like Bayer, Genentech and Sanofi. If mRNA technology proves to be a broadly applicable to other diseases, Pfizer will be significantly behind in capitalizing new markets.

Low market reaction despite profitable year: Pfizer saw a 23% increase in revenue with approximately 1% increase in operational spending from the last fiscal year. The increase in revenue is primarily due to BNT162b2 and the pandemic. Despite a great financial quarter, Pfizer has been trading between $30.28 to $45.86 (ATH) during since late 2019. In contrast, BioNTech has jumped from $22.66 to $433.90 (ATH) within the same period. It is clear that BioNTech is receiving the bulk of investor attention for their innovative mRNA technology and SARS-CoV2 vaccine.

Increasing vaccine competition: Merck is set to challenge Prevnar13 with Vaxneuvance for use in pediatric patients, which is 80% of the market. 33 Vaxneuvance is a cocktail vaccine for S. pneumoniae serotypes 1, 3, 4, 5, 6A, 6B, 7F, 9V, 14, 18C, 19A, 19F, 22F, 23F and 33F.34 Vaxneuvance covers serotypes 22F and 33F, which Prevnar13 does not. In a head-to-head phase 3 study comparing Vaxneuvance to Prevnar13, Vaxneuvance showed higher immunogenicity to serotypes 22F and 33F than Prevnar13 with similar safety profiles in children. Although Pfizer’s recently approved Prevnar20 covers 22F and 33F, phase 2 clinical trials in children are still on going and has yet to be approved. Vaxneuvance is currently under FDA review following positive phase 3 results.

Investment Recommendation — Hold

Pfizer’s stock is undervalued and has not performed in accordance with the surge in revenue from SARS-CoV2 vaccine sales. Pfizer is expected to continue generating COVID19 related revenue well beyond 2022 as the pandemic is still on going around the world. The success of mRNA vaccines has created new opportunities for biotech companies to disrupt a market largely dominated by 4 pharmaceutical companies. Large cap pharmaceutical companies have taken notice and those who are quick to adopt the new technology will likely strengthen their offerings in future. Pfizer’s acquisition of BioNTech is unlikely and chances of new breakthrough mRNA medicines are low.

References

1) Pfizer Second Quart 2021 Earnings Teleconference, July 28 2021.

2) https://www.pfizer.com/science/drug-product-pipeline

5) https://www.cdc.gov/pneumococcal/about/infection-types.html

6) https://www.immunize.org/askexperts/experts_pneumococcal_vaccines.asp

7) https://www.cdc.gov/globalhealth/immunization/sis/vacs_detail.htm#Pneumo

9) https://www.cdc.gov/pneumococcal/surveillance.html

10) https://www.fiercepharma.com/special-report/top-20-drugs-by-2020-sales-prevnar-13

11) Pfizer Inc SEC Form 8-K

12) http://www.pmlive.com/top_pharma_list/pharmaceutical_products/prevnar_13

13) https://www.cdc.gov/meningitis/lab-manual/chpt02-epi.html

14) Pelton, S. I. (2016). The Global Evolution of Meningococcal Epidemiology Following the Introduction of Meningococcal Vaccines. Journal of Adolescent Health, 59(2), S3–S11. https://doi.org/10.1016/j.jadohealth.2016.04.012

15) https://www.pfizer.ca/sites/default/files/202010/Nimenrix_PM_EN_232784_25-Sep-2020.pdf

16) https://www.pfizer.ca/sites/default/files/201907/Trumenba_PM_E_220373_24May2019.pdf

17) https://www.precisionvaccinations.com/vaccines/menabcwy-meningococcal-pf-06886992-vaccine

18) Pelton, S. I. (2016). The Global Evolution of Meningococcal Epidemiology Following the Introduction of Meningococcal Vaccines. Journal of Adolescent Health, 59(2), S3–S11. https://doi.org/10.1016/j.jadohealth.2016.04.012

19) Number of new cases of meningococcal disease in the U.S. from 1970 to 2018. Statista. Accessed July 30 2021.

20) https://www.cdc.gov/dotw/sars/index.html

22) http://www.emro.who.int/health-topics/mers-cov/mers-outbreaks.html https://www.medicalnewstoday.com/articles/how-did-we-develop-a-covid-19-vaccine-so-quickly

25) https://connect.uclahealth.org/2020/12/10/the-fastest-vaccine-in-history/

26) https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7938284/

27) https://ourworldindata.org/covid-vaccinations

28) https://www.ft.com/content/657b123a-78ba-4fba-b18e-23c07e313331

29) https://www.evaluate.com/vantage/articles/news/trial-results/mercks-covid-19-vaccines-head-scrapheap

31) https://www.nature.com/articles/d41586-021-02109-1