Ethereum’s London Hard Fork and the road to POS

Writer: Harsh Mandaviya

If you’re a blockchain enthusiast or even a small-time retail Ether investor, the news surrounding Ethereum’s latest upgrade dubbed “London hard fork” may have surely caught your attention. Unlike previous upgrades, the London hard fork is an important one in Ethereum’s plans to transition from a POW (Proof of Work) to a POS (Proof of Stake) ecosystem. London hard fork contains a series of EIPs (Ethereum Improvement Proposals) most notably EIP 1559. The hype surrounding this upgrade also helped inflate crypto prices that had seen a declining price trend in the past 2 months.

So, what exactly happened at 12:34 UTC on 5th August when Ethereum’s block number 12,965,000 officially activated the fork? Before we learn about the upgrade, it’s important to know how Ethereum’s blockchain was running so far to understand the problems it faced that led to this upgrade.

Ethereum’s current POW mechanism

Ethereum was created to solve some of the problems associated with the Bitcoin blockchain, however the network was never perfect. While Ethereum is home to some of the most innovative DeFi platforms, NFTs and smart contracts; scalability has always been an issue. This is because Ethereum is a POW (Proof of Work) blockchain. In a POW system, the miners (block validators) compete with each other to validate each block. They devote their computing power to solve complex cryptographic puzzles. The system that solves this puzzle the quickest gets to validate the block. The miner provides the proof of solving this cryptographic puzzle, if this proof exists then the block is valid. This proof is called POW (Proof of Work). The power consumption to validate transactions in a POW blockchain like Ethereum or Bitcoin is so high that it is equivalent to that of the power consumed by smaller nations like New Zealand or Hungary. This has a serious mark on Ethereum’s carbon footprint.

POW network can also defeat the purpose of blockchain i.e decentralization. Miners with stronger computing power and financial resources can keep investing in powerful systems to take advantage of economies of scale. In doing so, there could potentially be a possibility where big miners can collude to form a pool and could oust competition.

The gas fee dilemma before EIP 1559

A miner receives transaction fee (gas price) that a blockchain user pays for their service. In addition, the miner is also rewarded 2 ETH for each block mined. These benefits help miners offset the heavy costs associated with mining that includes heavy electricity costs, expensive hardwares and maintenance.

Gas is the fuel that runs the Ethereum blockchain. It’s a transactional unit that a user buys that corresponds to the computational power required to validate their transaction. Gas price is the fee that a user is willing to pay to the miner per unit of gas. The currency of gas payment is gwei. It’s the smallest unit of Eth — think of gwei as cents and Eth as dollar. 1.0 ETH = 1,000,000,000 gwei. When a transaction is initiated, it goes to a mempool (memory pool) where it waits along with 1000s of other transactions to be picked up by miners in order to be added to a block. The problem with gas price is that there’s no proper mechanism to estimate it which is why Ethereum blockchain has the highest transaction fee of any network. During heavy network congestion, a user can bid to pay a higher gas fee based on how quickly they want the transaction to be picked up. This is a type of “first-price auction” where a bidder (user) doesn’t know the bid amount of other users in the network. This can lead to a higher gas price bid as a user can bid to pay 200 gwei in gas price/unit when the next highest bid could have had been as low as 80 gwei. Naturally the higher the gas price a user is willing to pay, the higher is the chance that a miner would pick up the transaction on priority as this would maximize a miner’s profit.

How many transactions can fit into one block? Well, this fluctuates. Each block has a gas limit of 15 million & the base cost of any transaction is 21,000 units of gas. Let’s assume you’re sending a unit of Eth to a friend. This would be a simple peer to peer transaction that would require lower gas (or lower computational power). The gas required in this case would be 21000 units. The user can decide what’s the maximum gas price he/she is willing to pay per unit. In our example above, if the user choses to pay 200 gwei per unit, the total transaction fee would be 21000 units * 200 gwei = 4,200,000 gwei or 0.0042 Eth. At the time of writing this, Ethereum is valued at 3,963 CAD and hence the transaction fee would be 16.64 CAD. Similarly, the same user can opt to pay a gas price of 400 gwei during network congestion if they wish to initiate the transfer ASAP.

If the mempool contains transactions that requires a smart contract, the gas required would be much higher as this would require more computational power to check if conditions coded in the smart contract are met. A smart contract transaction can sometimes take upto 50% of the block size depending on how complex it is.

London hard fork and EIP 1559 — The new fee model

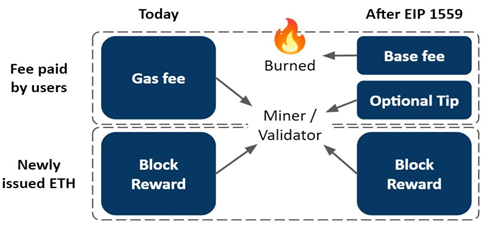

This new upgrade aims to make the gas price more predictable and this affects how miners will be compensated for their work. There is no longer a gas fee but an algorithm that determines a base fee based on network traffic. The algorithm aims to achieve network equilibrium at 50% capacity. This means that when the network is over 50% utilization, the base fee is incremented and vice versa when the network is running below 50% utilization. The target limit of each block is still 15 million but the block size limit can now be doubled to 30 million per block during heavy network congestion. Miners will be able to validate more transactions in a block which will improve transaction speed.

Perhaps from an investor’s standpoint, the biggest kicker is that this upgrade would make Eth deflationary. The base fee that the user will pay would no longer go to the miner but rather be burnt in the network. This will reduce selling pressure on miners and could potentially reduce Eth supply in the market. However, we’re still in the early stages to know how this could affect Eth’s price in future.

This upgrade is also controversial and not all miners are on board for the obvious reason that this would greatly reduce their income. In order to offset the loss in transaction fee, the upgrade allows users with an option to tip the miner over and above the base fee to prioritize their transaction. 100% of this tip will go to the miner.

POS — much needed upgrade coming soon

Moving from POW to POS has been on Ethereum’s roadmap plan since inception. In a POS (Proof of Stake) mechanism, miners are replaced with validators. These validators are network participants who have a stake in the network. In order to be a validator, one must stake a minimum of 32 Eth on the network. A validator is randomly chosen to create a block and is also responsible for verifying blocks that they don’t create. Unlike POW, validators don’t need to use high computational power nor have to compete amongst each other to mine a block. This makes the process efficient in terms of energy consumption as well as boosts transaction speed. The incentive to a validator is through interest generated on their staked Eth. When a block of code is created, other validators in the network have to verify and approve. If approved by majority, the block creator gets the reward.

POS is also more decentralized than POW. This is because POS will encourage more participants (nodes) on the network as all that is required to be a validator is a basic computer, a stable internet connection and staked Eth. POS also provides better security against a 51% attack as the validator would need to own 51% of the staked Eth which makes it practically impossible given how expensive this could be. A validator that is engaged in verifying fraudulent transactions either on purpose or through an oversight will be penalized and will lose a portion of their stake, possibly the entire staked Eth in serious situations.

Sharding — scalability is the key

Ethereum currently processes about 15–30 transactions per second. The rate at which Defi and crypto sector is growing, achieving scalability is the need of hour. When a block is mined or validated, it goes to every validator/miner in the network for verification. This process of finding a consensus happens in a linear manner. This is a time-consuming process. Each validator/miner also retains a copy of the entire blockchain database in their system. While this makes the network secure, it severely hampers scalability.

Ethereum 2.0 aims to solve this through sharding. Sharding is a method that the splits database into fractions. On a high level, a validator will only have to validate the sharded block that will contain only a fraction of the transactions. The validator’s system will only store the database pertaining to the shards they validated and not the entire database. This makes the process much faster while ensuring decentralization. Every participant on the network will still be able to view the entire database as the location of each sharded block will be mapped on the blockchain. Below is a simple example of how shards work using a simple Excel database.

2021/22 is definitely an exciting year in blockchain space. Lots of improvements coming!

Key takeaways:

- While EIP 1559 addresses the problem with unreliable gas prices, it doesn’t really make the gas price cheaper but rather implements a process that makes it predictable.

- EIP 1559 could potentially make Eth a deflationary asset that could drive up its value.

- POS and Sharding is the much-needed upgrade as it would make Ethereum environment friendly while ensuring scalability.

References

1) https://www.theblockcrypto.com/post/113595/ethereums-london-hard-fork-what-it-is-and-why-it-matters

2) https://zipmex.com/au/learn/ethereum-london-hard-fork/

3) https://ethereum.org/en/developers/docs/gas/

4) https://academy.ivanontech.com/blog/breaking-down-eth-2-0-sharding-explained

5) Ethereum Sharding explained — https://www.youtube.com/watch?v=5bOO7P-tZ3U