Chainlink (LINK) — DeFi Protector and Enabler

By: Tom Wan

Disclaimer: We are not offering financial advice. Below information is educational and knowledge-based analysis.

A. Introduction

Chainlink has been an indispensable piece in the defi space. It is known for providing oracle services to different blockchains, enabling them to connect with real world data. With reference to Chainlink’s cofounder Sergey Nazarov, more than 300 defi projects have already integrated them as oracle providers. In March 2020, Chainlink’s price feeds were being used by 7 of top 15 most used defi protocols (Chart 1).

Defi giants like Aave (AAVE), Synthetix (SNX), Yearn.finance (YFI), etc. are also clients of Chainlink. Therefore, it is of no doubt that Chainlink is a very influencing puzzle in the defi sector. In Chainlink’s whitepaper 1.0, their vision is to provide decentralized oracle services so that smart contracts can avoid using centralized servers which will expose them to the risk of a single point of failure. In hindsight, Chainlink has successfully achieved their goal. Yet, Chainlink’s offerings are not just limited to oracle services. To look into the success of Chainlink as well as their importance to the defi space, this research will be focusing on the below aspects:

1. Chainlink’s current offerings to the Defi space (AMM, Derivatives, Lending)

2. LINK’s utility, social data, on-chain data and price analysis

3. Chainlink’s possible setbacks

B. Chainlink’s Current Offerings to DeFi

- Founding Team and Chainlink’s History

CEO Sergey Nazarov and CTO Steve Ellis founded a company called SmartContract in 2014, which is the parent company of Chainlink. The Chainlink 1.0 whitepaper was written by Sergey and technical advisor Ari Juels. In September 2017, Chainlink launched an Initial Coin Offering (ICO) which has secured $32 million USD for 35% of their LINK token. Chainlink has officially launched their mainnet on 30 May 2019 and started connecting real world data to different blockchains. Some major adoption of Chainlink including Everipedia (A blockchain based Wikipedia) using Chainlink to get the official 2020 president election results from data outside the blockchain and provide it to EOS and Ethereum after verification. In April 2021, the team released Chainlink whitepaper 2.0 outlining their future roadmap and upgrades.

2. Quick Overview

Chainlink’s main service is linking the blockchain smart contracts to real world data. There are 88 Blockchains that are supported by Chainlink at the moment including Ethereum, Polkadot, Solana, Cosmos. In the meantime, they also have a strong network of partnerships such as SWIFT, Google, Oracle, Gartner, to name but a few. They are also working with Intel, Microsoft and IBM on Hyperledger Avalon. Unlike traditional centralized oracle providers, Chainlink is an ecosystem that involves numerous decentralized oracle networks (DONs). Each network can provide different services independently such as:

a. Decentralized Price Feed

b. Proof of Reserve

c. Verifiable Random Function (VRF)

d. Cross-Chain Interoperability Protocol (CCIP)

e. Off-Chain Computation

f. Modular External Adapters

g. Keppers

While Chainlink has a wide range of solutions, we will focus on the solutions which apply to the Defi space only.

3. Decentralized Price Feed

Mechanism:

Chainlink currently has 50 data providers. Most of them are related to crypto including Coingecko, Binance, Kraken, Huobi, etc. In order to capture accurate price feed, Chainlink will receive price data from both Centralized Exchanges and Decentralized Exchanges. After aggregating the data, DONs will generate a manipulation resistant price update as a form of reference contract according to the price updates from the data providers. Eventually, smart contracts can easily pull the updated price feed using the reference contract.

Application In Defi:

Price feeds are important for valuation in the lending space. In December 2020, Warp Finance suffered in a $7.7 million flash loan attack. The rationale behind is due to their sole price oracle being manipulated. With the implementation of Chainlink’s DONs, Aave, Compound and Rari Capital are able to retrieve real time market data which is resistant to price manipulation. As a result, they can calculate the value of collateral and debt accurately to protect the users’ deposits.

DeFiDollar’s DUSD is a use case of stablecoin using Chainlink’s price feed. Chainlink enables DeFiDollar to track the real-time price of sUSD, USDT, DAI and USDC. If any of the above stablecoin deviates from the USD 1:1 peg, rebalance will be triggered to help DUSD get back to the dollar parity.

Synthetix is a derivatives platform that engages in Chainlink’s price feeds service. Synthetix can access the updated current value of the underlying assets that they have minted. This allows users to trade synthetic assets like commodities, equities, cryptocurrencies, etc. with no price deviation.

4. Proof-of-Reserve

Two major wrapped cross-chain assets, BitGo’s WBTC and Ren Protocol’s renBTC are powered by Chainlink’s Proof-of-Reserve service. In a bid to ensure the integrity of the asset deposits, Chainlink’s reference feed will extract the data needed to calculate the true collateral that is backed by Ren or Bitgo. As a result, Chainlink is able to offer transparency to the Defi market which can avoid overcollateralization.

5. Keepers

Synthetix and Aave are also the main users of Chainlink’s Keepers service. Keepers are able to automate smart contracts for revenue sharing and liquidations. For Synthetix, Keepers can automate the distribution of staking rewards to users. It will keep tracking the duration period stated in the smart contract and when the end date has come, the distribution of reward will be executed.

For Aave, Keepers can monitor the users’ level of collateral. If a trader has entered a short position with $3,700 USDT when BTC is priced at $37,000 using 10X leverage, the collateral will be liquidated by Keepers automatically and the position will be closed when the price of BTC hits $40,700.

C. LINK’s utility, social data, on-chain data and price analysis

1. LINK’s Background

LINK is an ERC-677 token. It is used for denomination, node operating fees and staking. As of 15 August 2021, LINK is priced at $26.28, which is almost half of its all time high ($52.7 on 10 May 2021). LINK’s current market cap is sitting at around $133M which is the 12th largest cryptocurrency in the market. It has a fixed quantity of 1000M tokens. With 350M being sold during the ICO as mentioned earlier, the remaining 350M will be used for incentive for node operators and 300M to SmartContract for continued developments. However, the current circulating supply is only 446M in the market.

2. LINK’s Previous Price Action

LINK was priced at 0.00038462 ETH during the ICO. As of 15 August 2021, the price of LINK has risen to 0.0083124 ETH, which is a 2000% growth. The main rationales behind LINK’s growing demand can be attributed into two folds, being the mainnet launch and the DeFi boom. The first parabolic uptrend started shortly after Chainlink’s launched their mainnet. Only one month’s time, Chainlink has risen from $1.00663 to $5.1 (With reference to Chart 9) which is a quick 400% growth. The next leg happens during the defi summer, the price of LINK has risen from $3.93796 to $20 (According to Chart 10) which is nearly a 500% move.

3. LINK’s On-Chain and Social Data

According to the data (As of 16 August 2021) from Intotheblock, the current exchanges outflows of LINK is greater than exchanges inflows by around $6 million. That could be a bullish sign as it could mean traders are more inclined to put their LINK tokens into their wallets instead of selling it on exchanges. However, traders have to be aware of the whales who hold LINK. The concentration by large holders of LINK (investors with more than 1% supply) is 78%, which means whales are very influential towards LINK’s price. Another point to note is LINK’s current price movement is highly correlated to Bitcoin’s price (0.94). Traders not only have to keep an eye on LINK’s price action but also Bitcoin’s.

For the social data, the official Chainlink telegram channel has 37,625 members (As of 16 August 2021). We have seens a slight increase of +0.01% change in the past 7 days. From analysing the messages from the members using sentiment analysis, intheblock has found 11% of the messages are positive and 1% are negative in the past 7 days. We can conclude that the community is overall positive towards Chainlink’s status quo at the moment. On the other hand, twitter’s sentiment holds the same results as well. 27% of the tweets are positive and 3% negative in the past 7 days. We also look into the Google trend of “Chainlink”. The searches have dropped during the market crash in May from 90 to 28 in June. While the market starts to recover, the google trend has a reversal as well. The searches increased from 14 to 40 during 11 July to 14 August.

4. LINK’s Development and On-chain Activity

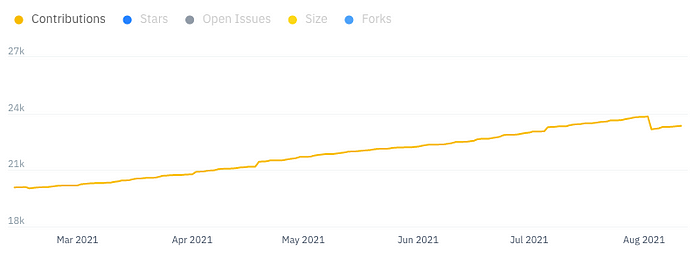

With reference to the data (As of 11 August 2021) from Binance Research, we can see from the chart below a steady growth in terms of Chainlink’s contributions (Sum of forks, commit and open issues) on github. With more contributions, it means more developers are using Chainlink’s github repository for development. For the past 7 days, we can also see a slight increase in overall contributions (0.8%) from 23.19k to 23.35k.

For the On-chain activity, we can see from the chart below (Chart 13) that the number of addresses with balance are increasing overtime. Even though we did not see a sharp increase recently in the number of addresses with balance, the steady growth could also be a bullish sign that investors are accumulating LINK or the user base is increasing. We can also note that the uptrend from March to May is steeper than the one from June to August. If we visit the price chart (Chart 14), we can see that the price from March to May has increased 88.3%. On the other hand, the price from June to August does not have significant change. The price of LINK did sink to 13.4 during July but it went back up to around the $30 range while the overall crypto market started to recover.

Another metric traders can look into is the number of transactions. We can see from Chart 15 that the number of transactions peaked during March. Even there’s another spike during May and June, the number of transactions still could not surpass the previous high. In hindsight, it could be a bearish sign as the price from March to May (Chart 14) increased by twofold while the number of transactions did not follow suit. The number of transactions could be a sign of the utility of LINK or the adoption of their services. If the number of transactions are going down but the price is going up, it could be a sign that LINK is overvalued at that period of time. We can also take a look at the number of large transactions (Transactions greater than $100,000). In chart 16, we can see there is a higher number of large transactions during May, which is aligned with the market crash that occurred in the same period ($52.99 to $15.0). The recent number of high transactions has decreased which means the whales’ action could pose a smaller effect on the price.

D. Chainlink’s Potential Risks

1. Zeus Capital FUD

In July 2020, Zeus Capital published a report named “The Chainlink Fraud Exposed”. Their claim is supported by evidence of Chainlink manipulating the market and not being decentralized. In November 2020, they even offer a bounty of $100,000 for those who can provide information regarding Chainlink’s manipulative and illicit practices. The research cited different sources of Chainlink could be doing a pump and dump scheme by doing bogus partnership announcements. The example they gave was the Google and SWIFT partnerships they announced in December 2019. However, Google Cloud’s twitter account did make a tweet on how to use Chainlink’s services to provide data from BigQuery. One notable quote in the report is cited from a blockchain analytics firm AnChain, which has published a research on how Chainlink did a pump and dump involving 4.2M LINK in 1 April 2019 to 26 July 2019. Aside from price manipulation, Zeus Capital also stated that Chainlink is lacking decentralization as they act as a gatekeeper for onboarding the node operators. As a result, it may pose a risk of Chainlink being a centralized authority of selecting favourable node operators instead of being truly decentralized. While both ways have its pros and cons, Zeus Capital suggests that Chainlink could be classified as a security due to its lack of decentralization. This may seem daunting as we have seen how Ripple has been affected by the SEC lawsuit. Nevertheless, if we refer to the Securities Framework Asset Ratings given by Crypto Rating Council (CRC), we can see that Ripple is given a rating of 4.00, Chainlink being 2.00 and Bitcoin is 1.00. These ratings range from 1 to 5. A higher score (Closer to 5) means the cryptocurrency is more aligned with the Howey test, which is a test that U.S. The Supreme Court used for determining whether an asset should be classified as a security. In this case, Chainlink should be safe from SEC. Even though this report is supported by various evidence and sources, their view might be biased since their investment thesis is to short Chainlink from $7.95 to $0.07, which is basically to 0. Yet, we all know how this ends since Chainlink is currently the 12th largest cryptocurrency.

2. Chainlink’s Monopolistic Behaviour

Chainlink is currently the largest oracle provider in the crypto space. Their market cap is around 24 times larger than the second largest oracle services, WINLink (As of 17 August). It may seem that Chainlink does not have to do anything to exclude other competitors as they are already dominating the market, but API3, another oracle service provider claims that Chainlink has been limiting smart contract platforms to employ or promote other oracle providers by giving them financial compensation. However, API3 did not support the accusation with any evidence in their article, which readers might think is not credible. On the other hand, if the claim is true, Chainlink may have been exposed to the risk that other oracle services might join hands together to tackle Chainlink’s exclusivity, which could lead to a plummeting price of LINK.

3. Chainlink’s Developers Selling LINK

According to a report from TrustNodes, the Chainlink developers have sold batches of 500,000 LINK tokens for $40 million after LINK peaked at $20 in August 2020. The token fell 20% in Coinbase just in one minute after LINK hit $20. TrustNodes has used etherscan for their investigation. They found out the developer team had moved the tokens to a stop address before sending it to Binance. They also do some shuffling beforehand, by breaking a large amount of tokens and sending it to different addresses as a way of obfuscating the transactions. Compare to Ripple’s developers’ selloff, Chainlink’s way are much less transparent and may lead to investors losing trust on LINK and their future development.

Summary

Chainlink is undoubtedly dominating the oracle services space in crypto. Though we only included Chainlink’s capabilities in the DeFi space, they also have presence in NFT, logistics, gaming, identity, etc. The current on-chain, social and development activities are leaning towards the bullish side. However, since LINK is highly correlated to Bitcoin, if Bitcoin could not break through the 48.4k level, LINK will also break down from the $30 range. We might see LINK retesting the $27.86 level which is the 200-day simple moving average if Bitcoin falls towards the 45k level. We can foresee the Ethereum upgrade EIP-1559 and Eth 2.0 will allow more DeFi applications to go live. Chainlink will definitely be one of the beneficiaries by that time.

Citations

https://decrypt.co/51015/2020-has-been-chainlinks-year-heres-why

https://research.chain.link/whitepaper-v1.pdf?utm_source=chainlink&utm_medium=whitepaper-page&utm_campaign=research

https://drive.google.com/file/d/1ve5s2UWkjWcSWBZoK5cQWMhkqOX4DAs_/view

https://www.chainlinkecosystem.com/ecosystem/

https://blog.chain.link/44-ways-to-enhance-your-smart-contract-with-chainlink/#decentralized-finance

https://azcoinnews.com/what-is-chainlink.html

https://crushcrypto.com/analysis-of-chainlink/

https://www.forbes.com/sites/michaeldelcastillo/2020/11/03/how-to-track-official-election-results-on-ethereum-and-eos/?sh=2f09b48d3269

https://research.chain.link/whitepaper-v2.pdf

https://www.coingecko.com/en/coins/chainlink

https://app.intotheblock.com/coin/LINK?pid=binance&utm_source=binance_widget

https://t.me/chainlinkofficial

https://research.binance.com/en/projects/chainlink

https://zeus-capital.com/assets/The_Chainlink_Fraud_Exposed.pdf

https://docs.google.com/forms/d/e/1FAIpQLScq0EgVY3PVHE5Snaj3D8CeStvZHBXsVjDKr_oNYhEizjGpng/viewform

https://twitter.com/GoogleCloudTech/status/1139242028498374656?lang=en

https://anchainai.medium.com/cryptocurrency-trading-investigation-market-manipulation-the-link-token-abcc3aa47567

https://www.cryptoratingcouncil.com/asset-ratings

https://www.investopedia.com/terms/h/howey-test.asp

https://www.coingecko.com/en/categories/oracle

https://medium.com/api3/api3-x-matic-hackathon-postponed-58613c64bbd

https://www.trustnodes.com/2020/08/14/chainlink-devs-dump