2020–2021 Notable Technology IPOs

2020/2021 IPO and SPAC Activity

- IPO activity dampened during the first half of 2020 due to the pandemic, but Q3 saw a rebound in the markets for over 40% of capital raised in 2020.

- High levels of dry powder drove a rise in SPAC activity in 2020.

- There was record-breaking VC involvement, especially in healthcare and technology industries, in 2020.

- 2021 Q1: SPAC IPOs more active than through all of 2020; best performing quarter in 20 years; technology sector remained as top spot in activity.

Notable Technology IPOS:

Note: All figures in USD unless otherwise stated. Stock prices are updated for 5/12/2021 closing prices.

1Life Healthcare, Inc. (NasdaqGS:ONEM)

1Life operates a membership-based primary care platform under the One Medical brand. Membership is based on direct enrollment and employer sponsorship.

Analyst rating (Capital IQ): Buy, (High: 63/Median: 50/Low: 46)

Drivers: Hybrid model of telehealth and physical clinics gives it an edge over pureplay telehealth, slowly reaching profitability, major partnerships with corporate clients and clinics/hospitals.

Risks: Potential impact from lifting COVID-19 restrictions.

Agora, Inc. (NasdaqGS:API)

Agora provides Real-Time Engagement Platform-as-a-Service (RTE-PaaS) in China, the US and internationally. The RTE-PaaS offers developers with software tools to embed video, voice, and messaging functionalities into applications.

Analyst rating (Capital IQ): Outperform, (High: 82.8/Median: 70/Low: 55)

Drivers: New partnerships (e.g. HTC for AR/XR platforms) and overall positive sentiment.

Risks: Heavily shorted, but might present opportunity.

Lemonade (LMND)

LMND is an insurtech company offering insurance policies for homeowners, renters, and pet owners. It leverages data, AI, and behavioral economics to offer customers more affordable insurance policies, faster registration.

Analyst rating (Capital IQ): Hold, (High: 134/Median: 85/Low: 29)

Drivers: Low pricing power, AI powered platform to predict risks and defaults, insurance industry is huge, and access to enormous amounts of primary data, serves social causes by donating to charities

Risks: Competitive industry and presence of well-established players

Snowflake Inc. (SNOW)

Snowflake Inc. provides Cloud Data platform that enables customers to consolidate data into a single source to drive meaningful business insights, build data-driven applications, and share data.

Analyst rating (Capital IQ): Hold, (High: 515/Median: 298/Low: 245)

Drivers: Backed up Berkshire Hathway, a part of high growth cloud data industry, strong partnerships with Fortune 500 companies, high switching costs to competitors

Risks: Snowflake relies on public cloud infrastructure provided by AWS, Microsoft Azure, Google Cloud Platform, that compete directly with Snowflake

Snowflake’s Moat:

- Service Provided: Big Data has been gaining popularity for some time now and the pandemic has further accelerated the adoption of Big Data by companies. Snowflake provides a one-stop-shop for data management, data engineering, data analytics, and data sharing. All this is just paid altogether by the customer as a service. Their clients don’t need to worry about things like what database they need to set up, what parties to connect to that database, or how to migrate data from one part of the business to the other. Snowflake takes care of all this for them in return of a service fee.

- High switching costs: Snowflake has managed to strike contracts with a few Fortune 500 companies recently. The bigger the client is the more will be its data that will be managed by Snowflake. The bigger the data, the harder it will be for the client to transfer everything over to a competitor at the end of their contract with Snowflake. This works in the company’s favour as it grows its clientele.

If Snowflake is providing the same or similar services as the Big 3 in the cloud space, what warrants a high valuation for the unprofitable company?

Snowflake’s biggest advantage and disadvantage is that it is built using Amazon Web Services (AWS). The advantage being that Snowflake doesn’t own any hardware thereby reducing storage costs. The disadvantage being that AWS is a bigger player in the space than Snowflake and could easily wipe Snowflake out, given Amazon’s resources. Other competitors are Microsoft’s Azure and Google’s Cloud Platform. Both of these companies have the framework that they can use to provide services like Snowflake.

Palantir (PLTR)

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations.

Analyst rating (Capital IQ): Hold, (High: 30/Median: 22/Low: 17)

Drivers: Increasing number of multi-year client contracts, highly customized services for clients

Risks: High valuation, high operating costs due to specialized nature of service, company’s top 20 customers contribute more than 60% of total sales, high R&D expenses.

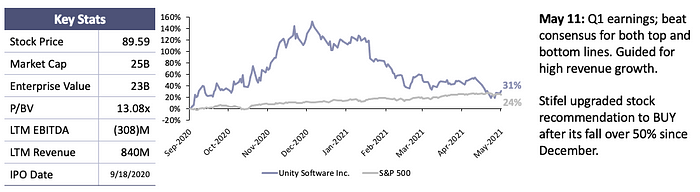

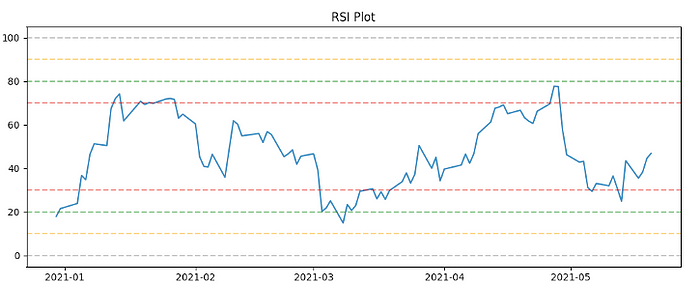

Unity Software Inc. (NYSE:U)

Unity operates a real-time 3D development platform that provides software to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles and AR/VR devices.

Analyst rating (Capital IQ): Outperform, (High: 170/Median: 123/Low: 75)

Drivers: 71% of top 1,000 mobile games use Unity’s services, AR/VR market and other verticals can also drive revenue.

Risks: Still expensive, still have not seen a positive bottom line due to high Research & Development and Sales & Marketing.

DoorDash, Inc. (NYSE:DASH)

DoorDash operates a logistics platform that connects merchants, consumers and dashers for food services.

Analyst rating (Capital IQ): Outperform, (High: 195/Median: 170/Low: 130)

Drivers: Focused on more profitable suburban areas compared to competitors, will see revenue growth.

Risks: Industry will compete for lower fees to attract customers, which indicates a lower margin business; with the population vaccinated, the tailwinds from the pandemic will subside as people return to sit-down dining.

Airbnb, Inc. (NasdaqGS:ABNB)

Airbnb operates a marketplace platform that connects hosts and guests online to book spaces and experiences globally.

Analyst rating (Capital IQ): Hold, (High: 245/Median: 180/Low: 74)

Drivers: Game-changer in the hotels and resorts segment, less topline impact than other major hotels, will see resiliency when travel restrictions lift.

Risks: An expensive stock with rising competition (i.e. VRBO, under Expedia).

Poshmark (POSH)

Poshmark, Inc. operates as a social marketplace for new and second-hand style products in the US, Canada, and Australia. The company offers apparel, footwear, home, beauty, and pet products, as well as accessories.

Analyst rating (Capital IQ): Hold, (High: 85/Median: 67.50/Low: 52)

Drivers: Market shift towards social commerce and growth in resale market, new product categories, network effect, growing number of active users

Risks: Heavy marketing costs for acquiring new customers, short-term slowdown as physical stores reopen.

Roblox Corp. (RBLX)

Roblox Corporation develops and operates an online entertainment platform

Analyst rating (Capital IQ): Buy, (High: 90/Median: 85/Low: 82)

Drivers: A variety of income-producing products and services, international expansion, investment in growing infrastructure.

Risks: Not yet profitable, high valuation currently. Management expects slowdown as economy reopens.

Other IPOs